Banking Solution

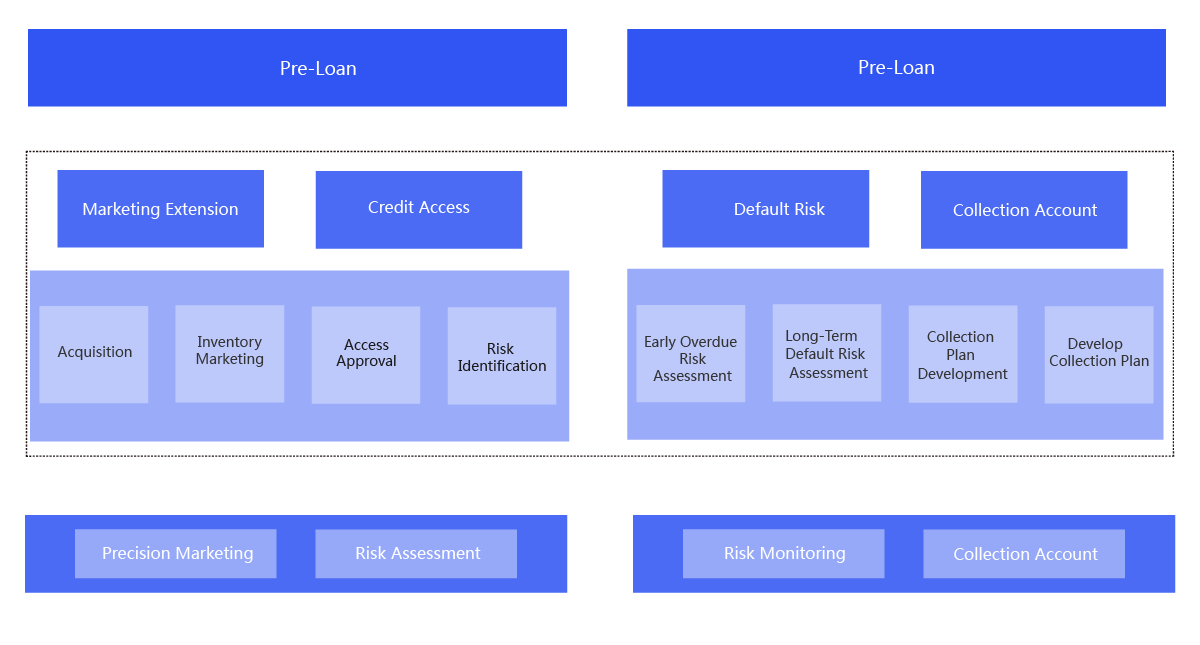

With the rapid development of the internet finance market and the introduction of new financial regulatory policies, banks face challenges in the reasonable and compliant use of personal data when implementing inclusive finance.

Shanghai ICP Preparation No. 沪ICP备2021019186号-1

Shanghai ICP Preparation No. 沪ICP备2021019186号-1